Видео ютуба по тегу Income Tax Information

ITR filing online AY 2025 26 | ITR 1 filing for salaried person | Income Tax Return filing

ITR Filing Online 2025-26 | Income Tax Return ( ITR 1) filing online 2024-25 (AY 2025-26) Old Regime

Indian Tax System Explained | All you need to know | Easiest explanation Ever | Aaditya Iyengar CFA

How the rich avoid paying taxes

Federal Income Tax Brackets: How Americans Pay Taxes

What is GST & Income Tax? Difference between both taxes I Indirect & Direct Tax I Startroot Fintech

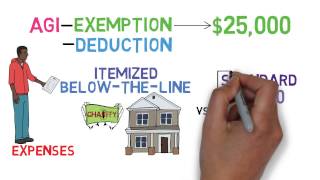

Tax Basics For Beginners (Taxes 101)

GST Explained | What is GST? Latest Tax Simplified for Beginners

How to Do Taxes For Beginners | Accountant Explains!

TDS Refund In ITR-1 Online In English || How to File ITR AY-25-26,FY-24-25

ITR Filing Complete Series | AY 2024-25 (FY 2023-24) | Salaried Person Income Tax Return

Taxes 101 (Tax Basics 1/3)

New Income Tax कैसे Calculate करें | कितनी कमाई पर कितना Tax लगेगा | SAGAR SINHA

REASON for NEW INCOME TAX!? | Ankur Warikoo #shorts

Income Tax budget 2025

GST Basic Questions and Answers.

ITR 2025-26 | 26AS,AIS,TIS Data Mismatch in Income tax return| ITR Filing online 2025-26 |कौन सा सही

Income Tax Basics Explained | Tax Rates | 5 Income Heads | Hindi

Tax & it's Type || Economy || Tax System in India || By Khan Sir #tax #kgs #khansir